How to Sell Your Business: Advice from a Miami Business Broker

David Currea has been bringing buyers and sellers of businesses together since 2008, working mainly in the area of Miami-Dade. For a free consultation, or a valuation of your business, please feel free to reach David at (305) 331-9918 or [email protected]. All conversations are completely confidential.

If you’re looking to sell your business for the highest price while keeping the transaction moving forward smoothly, follow the tips below, and you’ll be in great shape:

Have Your Financials In Order – and Recasted – Before Listing The Business For Sale

You don’t want to leave an interested buyer waiting for too long before they can review the info on your business.

Generally, you’d only provide buyers with a brief overview of the financial performance of your business, until they’ve made an offer (which you’ve accepted), and are in due diligence – at which point you provide more detailed financial statements.

In order to prepare this overview, it’s recommended you work with a business broker — in coordination with your accountant — in order to “recast” the financials.

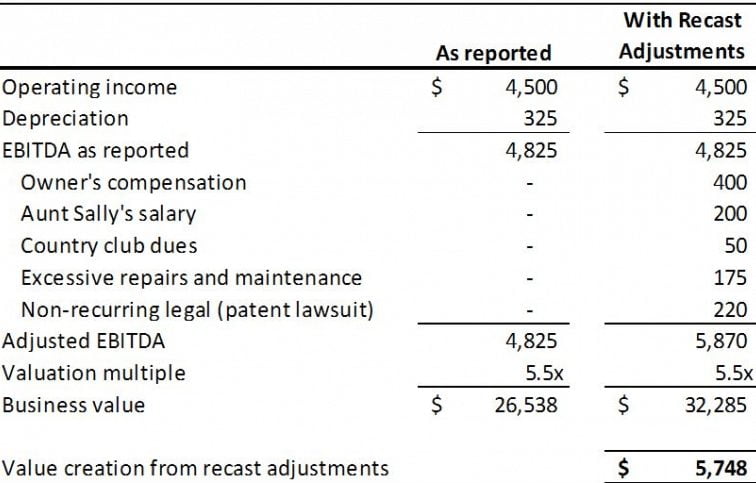

When recasting financials, a business broker will work with you to determine which expenses are personal or not related to the business (as well as large, one-time expenses), and add these back to the bottom line, reflecting a larger, more accurate net profit than what may appear on your financial statements.

Other “add-backs” include non-cash expenses such as interest, taxes, and depreciation, as well as the owner’s salary.

This better reflects the real operation of the business, making the opportunity much more attractive, and allowing you to justify a higher price point.

With your financials in order, you’ll be ready to go to market and strike while the iron’s hot when a buyer shows interest — without losing momentum.

Get a Proper Business Valuation – The Price Must Be Right

After having a set of recasted financials, your business broker will now have an idea what your business is really producing – the bottom line.

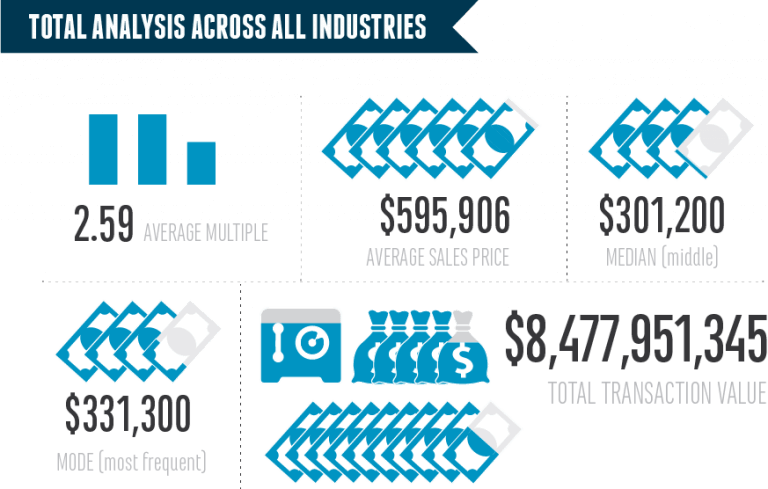

Much like valuations in real estate, a business broker will use “comparables” — other businesses sold in the same industry, preferably of similar size and in the same area — in order to find out how much businesses like yours are selling for.

Your business broker will take the net profit of your business – this bottom line, including all “add-backs” – and multiply it by a similar multiple of the net profit as these other businesses that have sold, in order to arrive at the price.

(For the more versed in this area, the broker will either use the EBITDA – Earnings Before Interest, Taxes, Depreciation and Amortization – or SDE – Seller’s Discretionary Earnings, sometimes known just as “Cash Flow).

It’s important you price the business right — price it too high, and run the risk of buyers not taking the time to take a look at it. Price it too low, and you leave money on the table…

Here at Capital Business Solutions, we use several different business valuation resources and are experts in the science of valuations. Contact David Currea at (305) 331-9918 or [email protected] for a quick conversation regarding the potential price of your business, or for a proper valuation.

Put Yourself In the Other’s Shoes When Negotiating – Buyer and Seller Should Work With Each Other to Get to the Closing Table

While we try to avoid it, most business deals can experience some “turbulence”… even when both sides set out with the best of intentions.

Buyers and sellers can sometimes take opposing sides on a matter, and the deal can come to a halt, or fall apart altogether, if neither side is willing to budge or compromise…

When both sides can keep an open mind and cooperate, a solution to almost any issue presented can be found that will keep the deal moving forward and both parties happy. A good business broker finds ways to creatively bridge these gaps and keep both parties on the same page as the deal progresses.

If Considering Selling Your Business, Don’t Go it Alone – Trust a Business Broker to Guide the Way

If you’re thinking about selling your business, you want a business broker – one who specializes in the sale of businesses – to represent you on the sale. I mention this as opposed to a real estate agent, or even a broker who specializes in commercial properties.

Nine times out of ten, real estate agent who is not a business broker does not have the requisite knowledge to properly represent you on the sale of a business.

A business broker much better understands financials, numbers, business processes and concerns, properly pricing your business as well as the the importance of confidentiality on the sale of a business. The importance of NDA’s, non-competes, SBA financing…

Note: All business brokers in the state of Florida must be licensed real estate agents, and often do have traditional real estate knowledge. Business deals frequently include real estate.

Business brokers also have the confidential marketing channels to get your opportunity in front of the right buyers, without putting you at unnecessary risk of employees, suppliers or competitors finding out about the sale. These are just a few of the advantages.

In the state of Florida, the best business brokers are members of the Business Brokers of Florida (BBF) association. Members of the BBF must demonstrate their expertise and abilities in business brokerage, and adhere to a strict code of ethics.

About the Author – David Currea – Business Broker

David Currea is a business broker, licensed real estate agent and and an essential part of Capital Business Solutions’ team of Miami business intermediaries. As a member of the Business Brokers of Florida (BBF), David has been successfully brokering business sales since 2008, handling transactions ranging from tens of thousands to several million dollars. If considering selling your business, please feel free to reach David for a valuation or a free, no-pressure consultation – (305) 331-9918 or [email protected].

David Currea is a business broker, licensed real estate agent and and an essential part of Capital Business Solutions’ team of Miami business intermediaries. As a member of the Business Brokers of Florida (BBF), David has been successfully brokering business sales since 2008, handling transactions ranging from tens of thousands to several million dollars. If considering selling your business, please feel free to reach David for a valuation or a free, no-pressure consultation – (305) 331-9918 or [email protected].